The expansion of audience targets within media, especially digital, has contributed to much debate around the usefulness of traditional demographics in media planning. However, age is still a very important variable in understanding differences in people’s online activity. This is particularly evident when looking at daily use of social media brands.

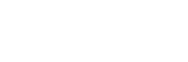

The graph below shows services ranked by average daily reach (the dark blue line) among 15-24s. On an average day, Instagram (53%) and WhatsApp (52%) are used by just over half of this age group, making them slightly more popular than Facebook (49%), Snap (45%) and TikTok (38%). When looking at the average daily time spent by users of each brand (the orange bars), the ranking changes significantly. 15-24s who use TikTok spend on average nearly 2 hours a day on the platform (118 minutes) which is way ahead of the other services. The brand with the 2nd highest engagement, Snap, has an average daily time spent of 80 mins whilst 15-24s spend less than 30 minutes each day on all other services including Instagram, WhatsApp and Facebook.

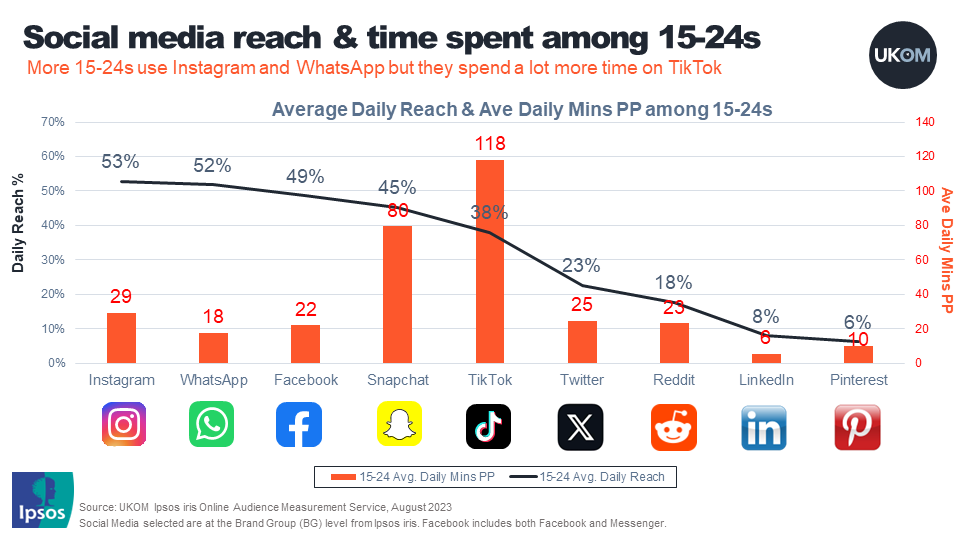

Keeping the axis and brand positions the same, we can look at the same data for the over 55s and the picture is very different.

Among over 55s, the platform with the highest daily reach is Facebook (62%), followed by WhatsApp (53%). Instagram, which was most popular among 15-24s, reaches less than a quarter of older people daily, while very few of them use Snap (2%) and TikTok (5%) each day.

Facebook is also the social platform where they spend most time – on average 46 minutes per day. Among the few that use TikTok, engagement is relatively high (average 31 mins/day) compared to other platforms but this pales in comparison to the time 15-24s spend on the video service.

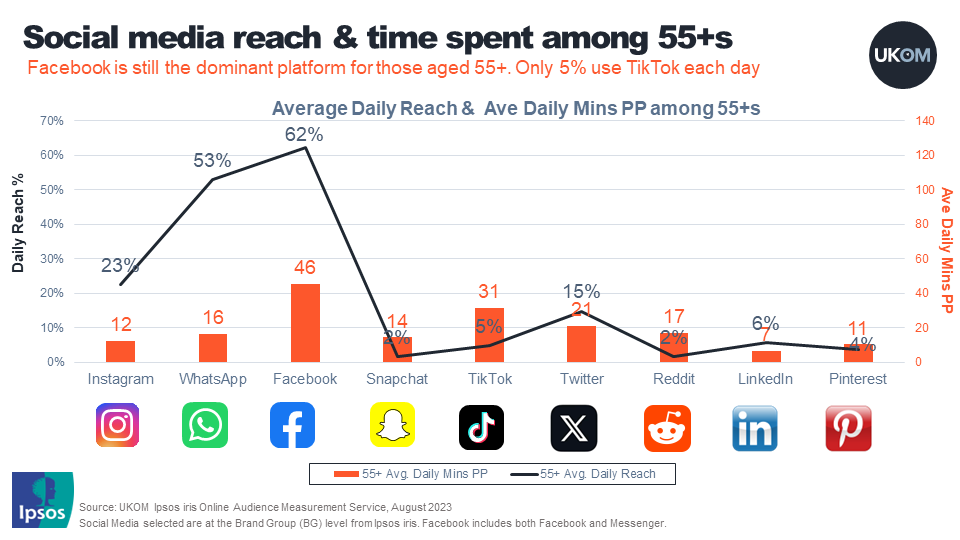

To illustrate this more clearly, the chart below overlays usage of both groups. This shows that Facebook is dominant for over 55s, whilst 15-24s use multiple services each day with TikTok accounting for most of their time. Interestingly WhatsApp has very similar daily usage levels for both age groups.

Whilst 15-24s are clearly spending A LOT of time every day on social media, audience de-duplication in Ipsos iris can help answer questions about multi-brand usage. For example, are those using TikTok and Snap the same group of very heavy category users or do young people favour one over the other? What impact do new brands have on existing services – is the time spent additive or do young people switch? How does a brand’s profile change as it matures?

Ipsos iris measures brand usage of 322 categories and data can be split by 577 target variables including ethnicity and sexual orientation. It is the UKOM endorsed industry standard for measuring UK online audiences and provides trusted, transparent data.

Notes on data:

Source: Ipsos iris Online Audience Measurement Service, August 2023

Base = all aged 15+ years using PC/laptop, smartphone or tablet device(s).

NB: Social Media selected at the Brand Group (BG) level from Ipsos iris. Facebook includes both Facebook and Messenger.