If you didn’t get round to purchasing an advent calendar or wanted to save your pennies, major brands are once again enticing you to open digital doors for free in the run up to Christmas. A couple of the biggest brands offering advent calendars online this year are M&S and John Lewis.

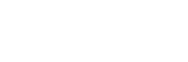

Last year UKOM highlighted the success of the 12 days of M&S Christmas promotion in driving visitors to its app – daily audience numbers increased from an average of 1.2 million to more than 4 million, peaking at 4.9 million on 8th December (see 2022 chart below). For perspective given retailers do see increases during the Festive period, the chart also shows the Tesco app, which did not run an advent calendar style promotion and rose only slightly during the same period.

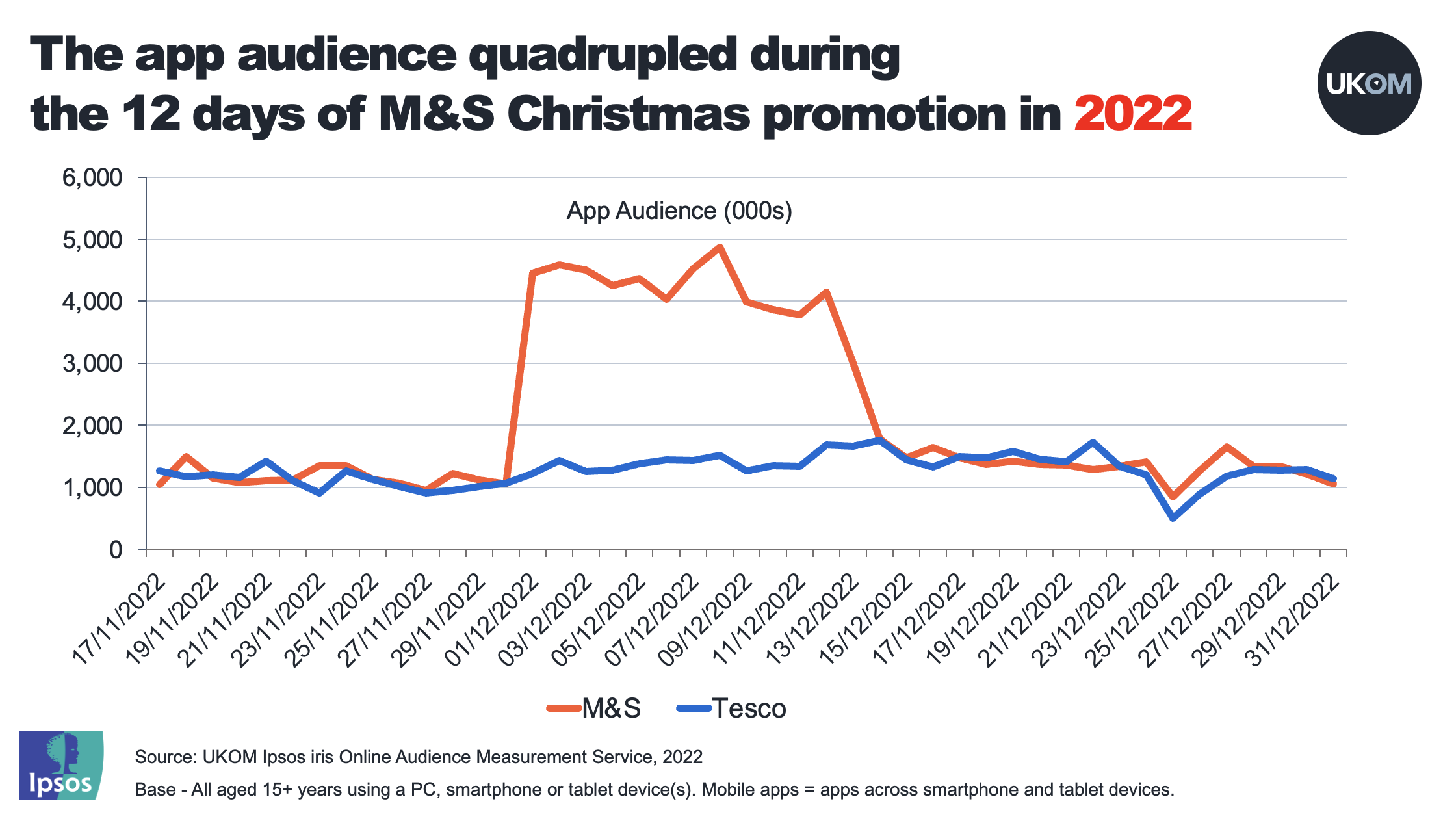

This year John Lewis has joined M&S with its ’12 treats of Christmas’, so how are they both performing in 2023? Early daily data from UKOM endorsed Ipsos iris shows that they are both attracting visitors. On 1st December – the first day of both campaigns, the M&S app audience was 238% higher than the day before (D) and for John Lewis it was up by 164%. Audiences for both apps were also greater than the same day the week before (W) which is particularly impressive given this was Black Friday – Friday 24th November. On 1st December, M&S had risen 44 places in the audience app rankings from 65 to 21, whilst John Lewis has risen 88 places from 169 to 81 compared to the day before. On the first day of the promotion, the M&S app audience was higher than the peak during the 12 days of Christmas promotion in 2022 (5.1m v 4.9m)

M&S typically has a much higher audience than John Lewis but both brands witnessed larger daily audiences than average during the first few days of December. M&S, which had an average daily audience of around 1.5 million in the last 2 weeks of November, saw daily app visitor numbers increase to 5 million. John Lewis had an app audience of over 1 million during the first few days of its 12 days of Christmas treats campaign, compared to an average of around 600k during the last 2 weeks in November.

It's too early to tell whether these increases will be sustained for the duration of the campaign or whether the novelty will wear off after the first few days. The challenge will be to get visitors to return to the app when there are no doors left to open. Last year, the M&S app audience remained high for the 12 days but visitors number dropped down to pre-promotion levels once it was over. Will the same happen this year? UKOM will update you in January…

For more information on Ipsos iris please click here. If you would like to know more about UKOM please click here or follow us on twitter at @UKOMAPS.

Notes on data:

Source: UKOM Ipsos iris Online Audience Measurement Service, 2022 and 2023. Mobile apps = apps across smartphone and tablet devices.

Base = all aged 15+ years using PC/laptop, smartphone or tablet device(s).

Tesco app data for 2022 is based on the Tesco Clubcard & Grocery Mobile App. 2023 data for M&S and John Lewis is from the Ipsos iris daily dashboard.